gamesome.ru Learn

Learn

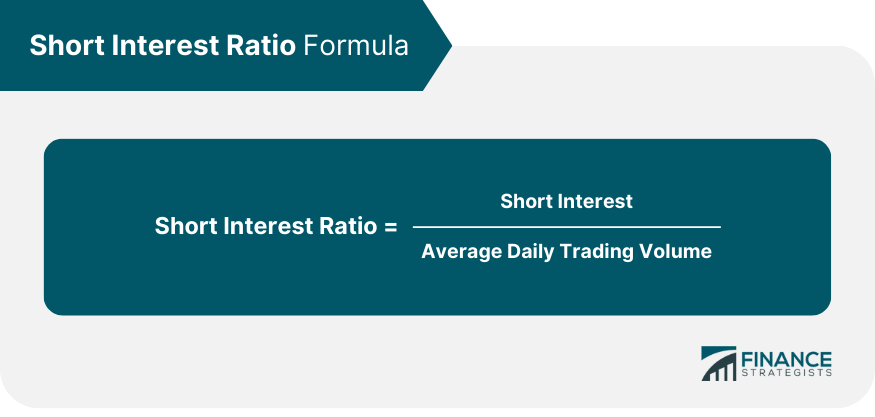

How Is Short Interest Calculated

The total amount of outstanding shorted shares is "short interest." Traders usually engage in short selling, which involves selling security by borrowing. When calculating the cost of borrowing stock at Interactive Brokers, a borrow fee and short sale proceeds interest are the factors for daily cost/revenues. Calculating the short interest on a company's publicly-traded stock involves dividing the number of shares sold short by the total float (i.e. total number of. The ratio is calculated by dividing the number of shorted shares by the average daily volume. For example, if the short interest is 5 million shares and the. short ratio, is a financial metric used to measure market sentiment towards a particular stock. It is calculated by dividing the total number of shorted. Unlike other sources, DataLend calculates the short interest indicator on a daily basis, providing an up-to-date source of such data, whereas other sources may. The ratio is calculated by dividing the total number of shorted shares of a stock by the average daily trading volume. When the short interest ratio is high. The 99th percentile short interest ratio cutoff is determined from a pooled sample of NYSE-Amex and Nasdaq firms. Company name. Short interest. (%). The short interest ratio represents the number of days it takes short sellers on average to cover their positions, that is repurchase all of the borrowed. The total amount of outstanding shorted shares is "short interest." Traders usually engage in short selling, which involves selling security by borrowing. When calculating the cost of borrowing stock at Interactive Brokers, a borrow fee and short sale proceeds interest are the factors for daily cost/revenues. Calculating the short interest on a company's publicly-traded stock involves dividing the number of shares sold short by the total float (i.e. total number of. The ratio is calculated by dividing the number of shorted shares by the average daily volume. For example, if the short interest is 5 million shares and the. short ratio, is a financial metric used to measure market sentiment towards a particular stock. It is calculated by dividing the total number of shorted. Unlike other sources, DataLend calculates the short interest indicator on a daily basis, providing an up-to-date source of such data, whereas other sources may. The ratio is calculated by dividing the total number of shorted shares of a stock by the average daily trading volume. When the short interest ratio is high. The 99th percentile short interest ratio cutoff is determined from a pooled sample of NYSE-Amex and Nasdaq firms. Company name. Short interest. (%). The short interest ratio represents the number of days it takes short sellers on average to cover their positions, that is repurchase all of the borrowed.

These reports are used to calculate short interest in Nasdaq stocks. View the Nasdaq Short Interest Publication Schedule. Data Fields & Definitions. The short. These reports are used to calculate short interest in NASDAQ stocks. NASDAQ member firms are required to report their short positions as of settlement on (1). Hey Everyone, Given a lot of the fiasco(s) regarding different "Short Interest Percentage Calculations", and how some reporting websites. When shorting in interactive brokers, it seems that the total interest charge is calculated as the borrow rate for the shares, no interest. The short interest data is just a snapshot that reflects short positions held by brokerage firms at a specific moment in time on two discrete days each month. Calculation: The days to cover ratio is calculated by dividing the total number of shares sold short (short interest) by the average daily trading volume of the. When calculating the cost of borrowing stock at Interactive Brokers, a borrow fee and short sale proceeds interest are the factors for daily cost/revenues. The metric's calculation also includes trading volume in the denominator, which results in a higher short interest value to thinly traded stocks. How to use. Short positions are those resulting from short sales. Each FINRA member firm is required to report its “total” short interest positions in all customer and. The short interest of a company can be indicated as an absolute number or as a percentage of shares outstanding. The short interest is looked at by investors to. Another way of defining the short-interest ratio is as a percentage of float. In this case, we calculate the ratio by dividing the number of shares sold short. The formula for the interest calculation will be: (Market Value x Rate x # of days) / For example: ($10, principal x 1% interest rate x 7-day holding. The formula for calculating the days to cover metric – also known as the short-interest ratio – divides the number of shares currently shorted by the average. The first is short interest, which is simply the number of shares that are being held in short positions by short sellers. US exchanges report official short. FINRA requires firms to report short interest positions in all customer and proprietary accounts in all equity securities twice a month. All short interest. Short interest represents the percentage of company shares that are sold short and haven't been closed out. Traders will short-sell stocks if they believe. Open interest is calculated by adding all the contracts from opened trades If Kurt decides to short the market and sells three contracts, open interest again. Interest rates can vary significantly. You may be able to short the most liquid shares for nothing, while the least liquid shares could come with an annualized. Short interest is not self-reported. FINRA and U.S. exchange rules require that brokerage firms report short interest data to FINRA on a per-security basis for.