gamesome.ru Recently Added

Recently Added

How To Compute Home Loan Amortization

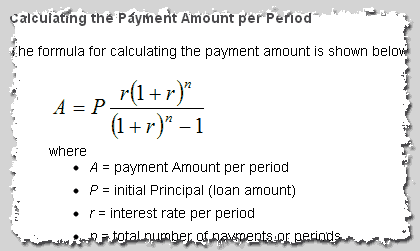

Loans that amortize, such as your home mortgage or car loan, require a monthly payment. · Convert the interest rate to a monthly rate. · Multiply the principal. Enter the loan amount, interest rate and amortization period (i.e., loan tenure) to instantly calculate your monthly payment and the sum total of all payments. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. This calculator will compute a loan's payment amount at various payment intervals -- based on the principal amount borrowed, the length of the loan and the. Starting in month one, take the total amount of the loan and multiply it by the interest rate on the loan. Then for a loan with monthly repayments, divide the. How To Use The Monthly Payment Calculator · Budget for an affordable monthly payment · Compare loan terms to see interest savings · View amortization breakdown per. Detailed analysis and formula of how to derive a mortgage payment and a full amortization loan schedule using a simple calculator or with a computer. A loan amortization schedule is calculated using the loan amount, loan term, and interest rate. If you know these three things, you can use Excel's PMT function. A loan amortization schedule is calculated using the loan amount, loan term, and interest rate. If you know these three things, you can use Excel's PMT function. Loans that amortize, such as your home mortgage or car loan, require a monthly payment. · Convert the interest rate to a monthly rate. · Multiply the principal. Enter the loan amount, interest rate and amortization period (i.e., loan tenure) to instantly calculate your monthly payment and the sum total of all payments. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. This calculator will compute a loan's payment amount at various payment intervals -- based on the principal amount borrowed, the length of the loan and the. Starting in month one, take the total amount of the loan and multiply it by the interest rate on the loan. Then for a loan with monthly repayments, divide the. How To Use The Monthly Payment Calculator · Budget for an affordable monthly payment · Compare loan terms to see interest savings · View amortization breakdown per. Detailed analysis and formula of how to derive a mortgage payment and a full amortization loan schedule using a simple calculator or with a computer. A loan amortization schedule is calculated using the loan amount, loan term, and interest rate. If you know these three things, you can use Excel's PMT function. A loan amortization schedule is calculated using the loan amount, loan term, and interest rate. If you know these three things, you can use Excel's PMT function.

This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. Our mortgage calculator reveals your monthly mortgage payment, showing both principal and interest portions. See a complete mortgage amortization schedule. Use this calculator to input the details of your mortgage and see how those payments break down over your loan term. A mortgage amortization schedule shows a breakdown of your monthly mortgage payment over time. Figure out how to calculate your mortgage amortization. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. Extra payments on a mortgage can be applied to the principal to reduce the amount of interest and shorten the amortization. To calculate amortization with an. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. Part of your monthly mortgage payment covers interest while another goes toward your loan principal. This allocation changes over time. Payments Formula · PMT = total payment each period · PV = present value of loan (loan amount) · i = period interest rate expressed as a decimal · n = number of loan. Mortgages, with fixed repayment terms of up to 30 years (sometimes more) are fully-amortizing loans, even if they have adjustable rates. Revolving loans (such. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. Amortization Calculator. An amortization calculator helps you understand how fixed mortgage payments work. It shows how much of each payment reduces your loan. Choose installment loan a that is fully amortized over the term. This option will always have a term that is equal to the amortization term. Choose balloon to. First Year NOI NOI equals all revenue from the property, minus all reasonably necessary operating expenses. To calculate DSCR, divide your net operating income. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. Or, enter in the loan amount and we will calculate your monthly payment. You can then examine your principal balances by payment, total of all payments made. Monthly Loan Calculator with Amortization. Principal. Amortization months. Help. Interest Rate. About. Or input payment. and. For illustrative purposes only. Enter your desired payment - and the tool will calculate your loan amount. Or, enter the loan amount and the tool will calculate your monthly payment. Use this Amortization Schedule Calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart.